In this Article:

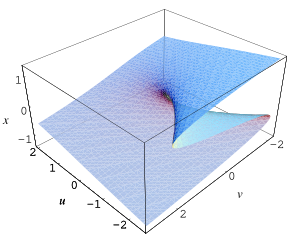

The cusp catastrophe model is a mathematical model that describes how a system can undergo a sudden, qualitative change in behavior as one or more of its control parameters are varied. The model is named after the shape of the surface that represents the possible states of the system.

The cusp catastrophe model has been used to model a variety of phenomena, including the behavior of stressed dogs, the decision-making process of consumers, and the onset of a disease. The model has also been used in economics, psychology, and other fields.

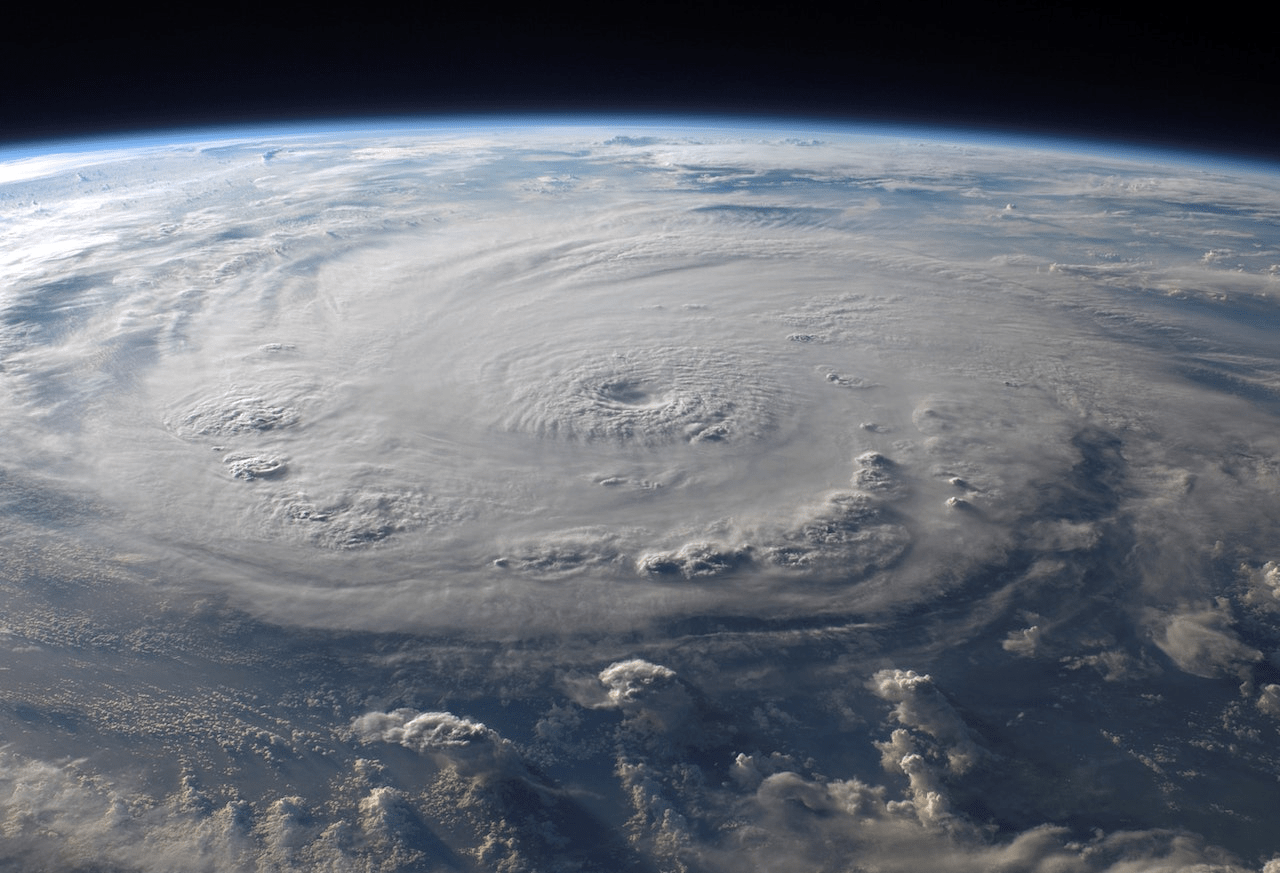

In insurance, the cusp catastrophe model can be used to understand how changes in risk factors can lead to sudden changes in the likelihood of a claim. For example, the model could be used to understand how changes in the weather, such as the intensity of a hurricane, can lead to sudden changes in the likelihood of damage to property.

The model could also be used to understand how changes in the behavior of policyholders, such as the amount of time they spend driving, can lead to sudden changes in the likelihood of an accident.

By understanding how changes in risk factors can lead to sudden changes in the likelihood of a claim, insurance companies can better price their policies and manage their risk.

Here are some specific ways that insurance companies can use the cusp catastrophe model:

To assess the risk of catastrophic events

The cusp catastrophe model can be used to assess the risk of catastrophic events, such as hurricanes, earthquakes, and floods. The model can be used to estimate the probability of these events occurring, as well as the severity of the damage they could cause. This information can be used by insurance companies to set premiums and reserves.

To predict the behavior of policyholders

The cusp catastrophe model can be used to predict the behavior of policyholders, such as how much they drive or how often they smoke. This information can be used by insurance companies to set premiums and target marketing campaigns.

To develop new products

The cusp catastrophe model can be used to develop new insurance products, such as those that offer coverage for catastrophic events or that reward policyholders for good behavior.

The cusp catastrophe model is a powerful tool that can help insurance companies better understand and manage risk. However, it is important to note that the model is only a simplified representation of reality. In reality, many systems are more complex than the cusp catastrophe model can capture.

Despite this limitation, the cusp catastrophe model can be a valuable tool for insurance companies. By using the model, insurance companies can better understand how changes in risk factors can lead to sudden changes in the likelihood of a claim. This information can be used to improve the pricing of policies, manage risk, and develop new products.